News

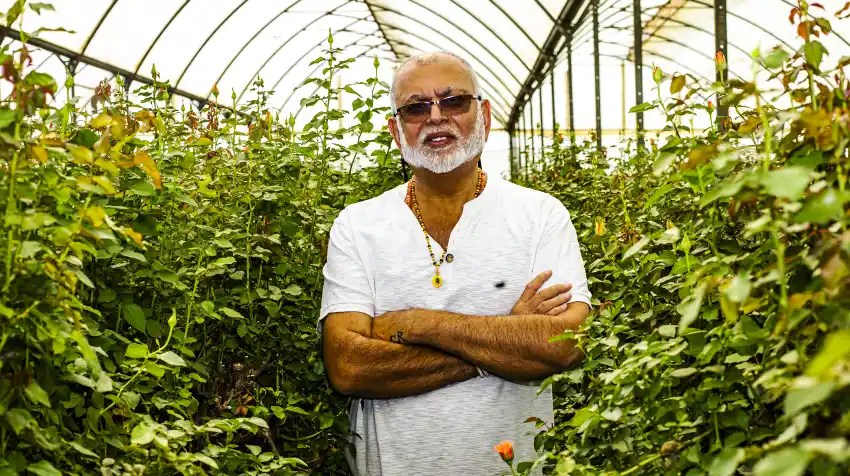

“Sudhir Ruparelia: The Art of Strategic Investing That Sets Him Apart in Uganda

Sudhir Ruparelia’s rise to become one of East Africa’s wealthiest businessmen is a remarkable story of resilience, strategic vision, and disciplined investment practices. Considered by Forbes as one of the richest individuals in the region, Sudhir is the chairman and majority shareholder of the Ruparelia Group, a conglomerate with diverse investments spanning banking, insurance, education, media, real estate, floriculture, and tourism. His investment philosophy has set him apart from other Ugandan businessmen, marking him as a standout figure in Uganda’s business landscape.

Ruparelia’s journey into business began when he moved to England as a young man. He successfully established several small businesses before returning to Uganda in the 1980s to seize opportunities arising from the nation’s improving political and business environment. In 1985, at just 29 years old, he founded the Ruparelia Group with $25,000 in savings from his time working in the UK. What began as a small trading firm has now grown into a vast empire, with notable assets including Speke Resort Munyonyo, Kabira Country Club, Speke Apartments, and Kingdom Kampala, as well as a number of properties acquired through strategic investments, such as Simbamanyo and Lotis.

What sets Sudhir apart from other Ugandan investors is his ability to manage risk effectively through diversification. Rather than avoiding risks, he spreads his investments across various industries, asset classes, and geographies, mitigating potential losses and capturing growth opportunities. This approach has been crucial to his success, especially in a market like Uganda, where risks can be high but the rewards are significant.

Sudhir’s investment strategy is guided by a long-term vision, avoiding the temptation to focus on short-term market fluctuations. He understands that the true value of investments is realized over time, which is why he remains committed to ventures like real estate, despite challenges in the current market. His trustworthiness is another key to his success, as he has built strong relationships with business partners and collaborators. For instance, Crane Bank once operated in branches owned by Meera Investments, a property development company under the Ruparelia Group.

Additionally, Sudhir’s exposure to international business platforms has given him valuable knowledge that helps him make informed decisions and avoid risky loans. Unlike many other Ugandan investors, he has avoided legal battles over unpaid loans, focusing instead on maintaining healthy financial practices. He is also known for involving his family in the business, with his wife and children playing active roles in the growth and sustainability of the group.

Discipline and analytical skills are hallmarks of Sudhir’s approach. He follows a well-defined investment strategy, avoiding the allure of fads or market trends. His decisions are based on thorough research and analysis of financial data, market trends, and economic indicators. At the same time, Sudhir remains humble, acknowledging that he doesn’t have all the answers and is always open to learning from his mistakes and seeking expert advice.

Finally, Sudhir practices value investing—looking for undervalued assets with potential for future appreciation. This strategy, combined with his patience and disciplined approach, has allowed him to achieve sustainable wealth creation over time. For Sudhir, being a good investor is not just about making profits, but about a philosophy of prudent decision-making, resilience, and long-term success.

In essence, Sudhir Ruparelia’s legacy as an investor is defined not only by his financial success but by the qualities and strategies that have enabled him to build and sustain his empire. His story is a testament to the power of strategic thinking, disciplined execution, and the value of learning from both successes and failures.