Business

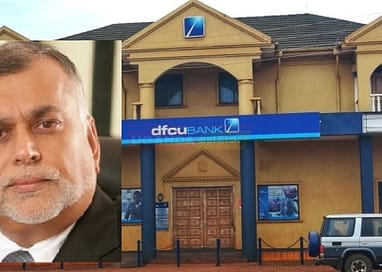

DFCU Bank In Deep Trouble: UK Court Sides With Sudhir, Rejects Financial Shield Amid Crane Bank Battle

In a pivotal legal development, the Commercial Court of England and Wales has dismissed DFCU Bank’s appeal for financial protections in its ongoing case with Crane Bank and prominent Ugandan businessman Dr. Sudhir Ruparelia. This ruling is a significant setback for DFCU, which sought security measures to shield itself from potential legal costs in the event of an unfavorable verdict.

The case, overseen by Mr. Stephen Hofmeyr KC, centered on DFCU’s request that Crane Bank’s claimants provide a financial guarantee to cover the bank’s costs should it lose the case. The litigation primarily concerns accusations that Ugandan officials, alongside the Bank of Uganda, orchestrated a scheme to take control of Crane Bank and subsequently sold it to DFCU at an undervalued rate.

In his judgment, Mr. Hofmeyr highlighted Dr. Ruparelia’s considerable wealth, emphasizing his financial ability to meet any potential cost orders that might arise. The decision was supported by evidence of Ruparelia’s significant assets across Uganda and the UK, affirming his capacity to fulfill financial responsibilities. Hofmeyr also noted Ruparelia’s consistent compliance with previous cost orders, diminishing the need for additional security as argued by DFCU.

DFCU’s push for cost security reflects its concerns over the potential financial ramifications if the case doesn’t go in its favor. However, the court found no justification for imposing further guarantees on Ruparelia and Crane Bank’s other claimants, given their proven financial standing and adherence to prior court directives.

This judgment further complicates an already high-profile case that has drawn widespread attention both in Uganda and internationally. The ongoing legal dispute, originating from Crane Bank’s 2016 takeover and subsequent sale in 2017, continues to uncover details about the contested acquisition of one of Uganda’s largest banks.