News

How Sudhir Ruparelia Built a Business Powerhouse in East Africa

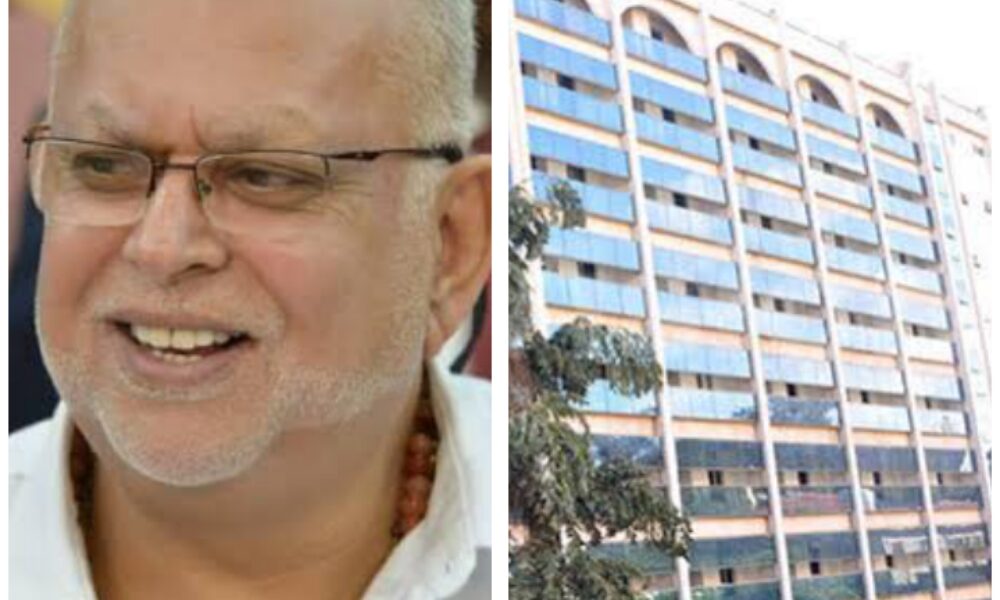

In Kampala’s central business district, glass towers, hotels and commercial arcades stand as quiet testimony to a businessman who has spent four decades shaping Uganda’s private sector. At the centre of that transformation is Sudhir Ruparelia, whose journey from exile to billionaire investor has become a reference point in conversations about African entrepreneurship.

While Africa’s wealth headlines are often dominated by industrialists such as Aliko Dangote, Ruparelia’s rise has followed a different script. His fortune, estimated at over one billion dollars, was built largely within Uganda’s borders through a strategy anchored in identifying domestic gaps and moving decisively to fill them. Associates say his approach has consistently favoured long term positioning over short term publicity.

Born in Kasese District and forced into exile during the 1972 expulsion of Asians under Idi Amin, Ruparelia spent his formative years in the United Kingdom undertaking modest jobs while studying the mechanics of finance and capital management. When he returned to Uganda in the early 1980s, the country’s economy was fragile and formal financial services were limited. With savings reportedly amounting to twenty five thousand dollars, he established Crane Forex Bureau, which later evolved into Crane Bank, at one time one of Uganda’s most visible indigenous financial institutions.

The closure of Crane Bank in 2016 marked a turning point. Analysts predicted a contraction of his empire, yet the years that followed saw renewed expansion in real estate, hospitality and education. Through Crane Management Services and related companies, Ruparelia consolidated a vast property portfolio that now includes office blocks, shopping centres and residential complexes that have redefined parts of Kampala’s skyline. Industry observers describe him as one of the country’s largest private property owners.

His hospitality investments under the Speke brand have also elevated Uganda’s profile as a destination for regional conferences and high level summits. Executives in the tourism sector say such facilities have played a critical role in positioning Kampala as a meeting hub in East Africa. “Private capital has been essential in bridging infrastructure gaps,” a tourism consultant noted. “Without that scale of investment, we would struggle to host major international gatherings.”

Beyond bricks and mortar, Ruparelia has consistently advocated for confidence in African markets. In previous public remarks, he has urged entrepreneurs to invest locally rather than waiting for foreign capital to drive development. Supporters argue that this philosophy has translated into job creation across sectors ranging from hospitality to higher education.

Philanthropy has also featured in his portfolio. Contributions to schools, health initiatives and disaster response efforts have reinforced his public image as a businessman who pairs expansion with social responsibility. Employees within his companies often describe a leadership style that is measured and disciplined, with emphasis placed on loyalty and internal growth.

As Uganda navigates rapid urbanisation and regional economic integration, analysts say figures like Ruparelia will continue to influence the trajectory of private sector development. His story, shaped by displacement, risk and recalibration, underscores the interplay between resilience and opportunity in emerging markets.

For many young entrepreneurs, the narrative is less about net worth and more about durability. In an economy that has weathered political shifts and global headwinds, Sudhir Ruparelia’s career offers a case study in adaptation. It is a reminder that in Africa’s evolving business landscape, longevity can be as powerful as scale.