Business

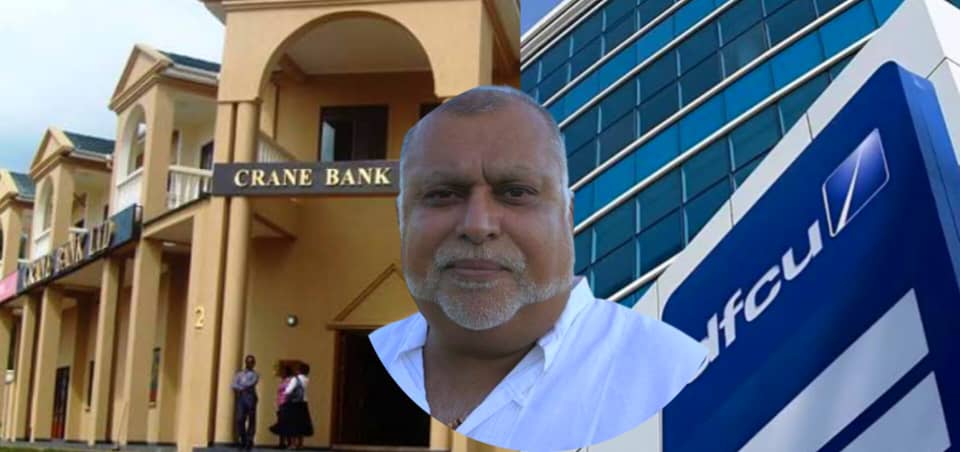

Sudhir Laughs Last as UK Judge Destroys dfcu Defence, Rejects PwC Audit Report

London, United Kingdom – In a resounding legal victory for Ugandan businessman Dr. Sudhir Ruparelia, the High Court of Justice in London has dismissed an attempt by dfcu Bank to rely on a disputed forensic audit report in the ongoing Crane Bank case. The ruling, handed down on July 24, 2025, represents a significant setback for dfcu and adds further weight to long-standing concerns about the integrity of the 2017 sale of Crane Bank following its controversial closure by the Bank of Uganda.

At the heart of the matter was dfcu’s attempt to amend its pleadings by introducing serious allegations of corruption and mismanagement against Crane Bank and its shareholders—claims grounded in a report purportedly authored by a company operating under the PricewaterhouseCoopers (PwC) name. However, the Court found that the entity responsible for the report was not licensed in Uganda and lacked the legal authority to produce such documents, thereby rendering the report inadmissible as evidence.

Justice Paul Stanley KC, presiding over the case, agreed with arguments presented by Crane Bank’s legal team that the report was fundamentally flawed, noting its lack of consistency and verifiability. “Several versions of the report exist—some signed, others unsigned, with differing content and conflicting dates. This makes them unreliable, as the Court cannot know which version, if any, reflects the truth,” the judge observed in his detailed ruling.

Further undermining the report’s credibility was the absence of critical supporting documentation. The court heard that the report lacked appendices and underlying data—an omission that prevented any proper examination of its conclusions. Crane Bank also emphasized that it has been denied access to its own records, now held by dfcu and the Bank of Uganda, making it impossible to prepare a fair response. The Court found this argument compelling and ruled that admitting such evidence would be prejudicial to the fairness of the trial.

In addition to striking out dfcu’s attempt to amend its defence, the Court rejected a wide range of disclosure requests from the bank. These included demands for access to personal phones, laptops, and email accounts of several Crane Bank directors and employees. The Court deemed most of these requests unjustified and overly intrusive, permitting only narrow, targeted disclosures—primarily limited to one email account belonging to Sheena Ruparelia and a few specified devices from the period between 2015 and 2019.

The Court also formally approved the substitution of the late Rajiv Ruparelia with his estate, now represented in the proceedings by his father, Dr. Sudhir Ruparelia. The decision reflects the continuing role of the Ruparelia family in pursuing justice in a case that has come to symbolize corporate governance and regulatory accountability in Uganda’s banking sector.

Legal observers have described the ruling as a turning point in the multi-jurisdictional legal battle over Crane Bank’s closure and sale. “By rejecting this tainted audit report, the UK court has reinforced the principle that allegations must be supported by credible, admissible evidence. This ruling significantly weakens dfcu’s position going forward,” said a source close to the case.

The fallout from the ruling is expected to intensify scrutiny on both dfcu Bank and the Bank of Uganda, whose actions in the Crane Bank saga have previously been criticized by the Auditor General and Uganda’s Parliament. In 2022, Uganda’s Supreme Court ruled in favour of Sudhir and Meera Investments, holding that the Bank of Uganda’s takeover of Crane Bank was illegal.

The UK ruling adds international weight to that position and may influence the direction of upcoming proceedings as the case heads toward a full trial. The Court has not yet fixed dates for the next hearings, instructing the parties to file further submissions before any schedule is confirmed.

With the PwC report now discredited, and dfcu’s broad disclosure demands largely denied, Dr. Ruparelia’s legal team appears to have gained significant momentum. The case remains one of Uganda’s most closely watched financial disputes, with implications that extend beyond the courtroom into the very heart of the country’s regulatory and corporate accountability frameworks.