Business

Landmark Supreme Court Ruling Shields Uganda’s Finance Sector, Confirms Sudhir’s Acquisition of Simbamanyo

By Gad Masereka

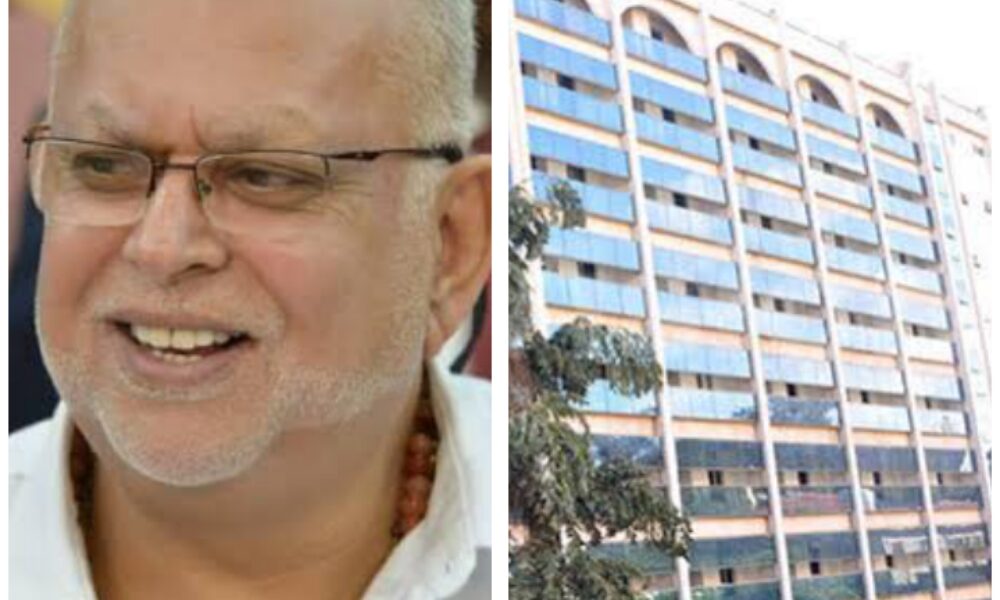

Kampala, Uganda: Uganda’s Supreme Court has delivered a landmark ruling that has reshaped the financial and real estate landscape, reaffirming the legality of cross-border lending and securing billionaire Sudhir Ruparelia’s acquisition of the once-embattled Simbamanyo House.

In June 2023, the court overturned a 2020 High Court judgment that had threatened to upend syndicated loans worth trillions of shillings. The ruling clarified that foreign banks do not require a Bank of Uganda license to lend to Ugandan borrowers provided they are not mobilising deposits from the public.

This restored confidence in cross-border financing and cemented the foundation for major transactions such as Ruparelia’s takeover of Simbamanyo House, which has since been renamed Gender and Labour House.

The financial implications of the ruling are profound. At the height of the legal battles, an estimated 5.7 trillion shillings in syndicated loans were at risk, unsettling sectors heavily dependent on such financing, including energy, infrastructure, and real estate.

Local banks, constrained by lending limits such as Stanbic’s 60 million US dollar cap for a single borrower, often rely on partnerships with foreign banks to underwrite large projects like the Standard Gauge Railway.

By removing legal ambiguity, the Supreme Court assured investors that Uganda remains a safe environment for cross-border finance. “This judgment secures the backbone of our economy by guaranteeing predictability in loan agreements,” a Kampala-based financial analyst said, noting that enforceable contracts encourage long-term investment.

The ruling, however, has not escaped criticism. Some financial experts warn it could open avenues for unregulated lending, with fears of increased exposure to money laundering risks.

Others argue that it sidelines parliamentary authority and may dilute the regulatory mandate of the Bank of Uganda. Yet supporters contend that these risks can be mitigated with stronger anti-money laundering safeguards and tighter monitoring without undermining foreign capital flows.

The Simbamanyo Estates saga remains the clearest example of the ruling’s impact. In July 2025, the High Court dismissed another challenge brought by Simbamanyo against a syndicated loan involving Equity Bank Uganda, Equity Bank Kenya, and Bank One Mauritius.

The court upheld the 2020 auction that saw Meera Investments, Ruparelia’s real estate arm, acquire Simbamanyo House for 18.5 billion shillings, while Afrique Suites went to Luwaluwa Investments.

The judge described the loan as a permissible commercial necessity, rejecting accusations of fraud and irregularity.

Ruparelia’s acquisition has since transformed a distressed property into a functioning state asset, now hosting the Ministry of Labour, Gender, and Social Development.

Observers say this not only validates the auction process but also demonstrates how distressed assets can be repositioned to serve public and economic needs. “The sale was necessary and lawful. Borrowers must be held accountable, even under void agreements, to prevent unjust enrichment,” the court ruled, citing the Contracts Act of 2010.

For Uganda’s financial sector, the judgment represents a pivotal moment. It underscores the principle of borrower responsibility while protecting the integrity of loan agreements, a balance seen as vital for sustaining economic growth.

For investors like Ruparelia, it provides clarity that well-structured deals will withstand legal scrutiny, encouraging further reinvestment in the country’s economy.

The Supreme Court’s ruling has fortified the credibility of Uganda’s financial system, safeguarded foreign capital inflows, and affirmed lawful property transactions.

The case has also revived public debate on the need for Parliament to create clear guidelines that balance regulatory oversight with openness to international finance.

As one economist observed, “Uganda has won a battle for stability, but the bigger challenge will be designing a system that secures both growth and accountability.”